Covid lockdowns return to key Chinese port cities

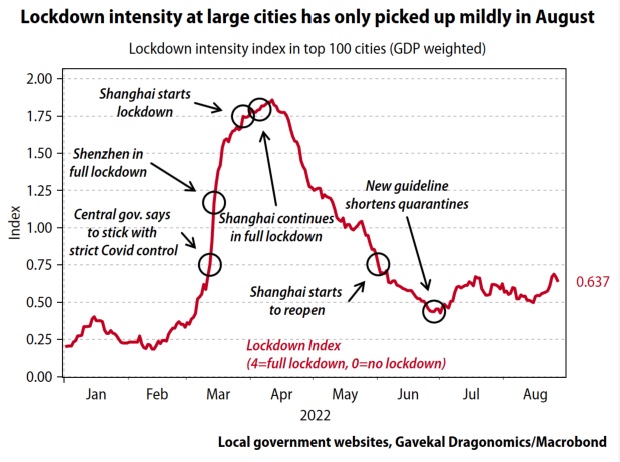

Covid lockdowns are ticking up in China again with neighbourhoods in key port cities such as Shenzhen and Dalian forced back home this week, and mass testing underway at other important maritime gateways including Tianjin.

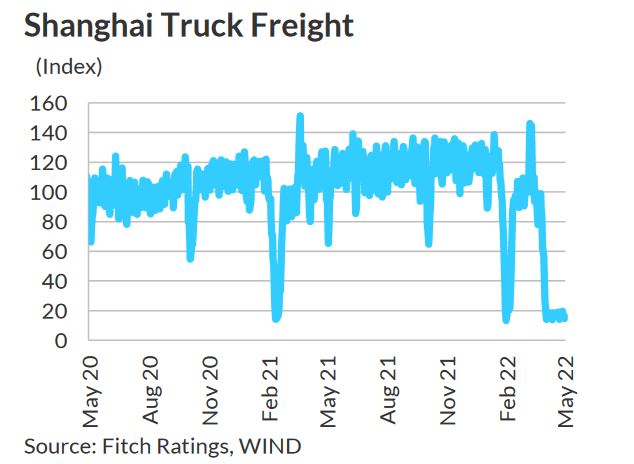

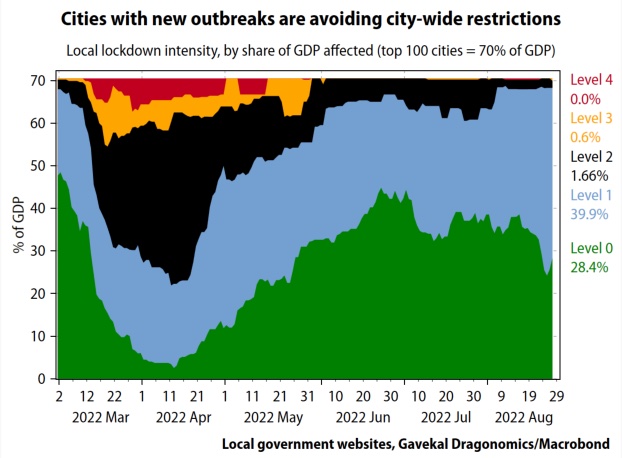

There is no let up in the government’s zero-covid policy, which has stretched global supply chains a great deal this year. The difference today is that while outbreaks have been getting more widespread in the last fortnight, lockdowns are pursued neighbourhood by neighbourhood rather than city-wide, and quarantine times have been cut back since the middle of June, according to analysis from research firm Gavekal Dragonomics.

Nevertheless, the quickening spread of the omicron variant has some analysts concerned.

At a news conference Monday, Shenzhen officials said the latest outbreak is mainly driven by new subvariant Omicron BF.15, which they said is more transmittable and harder to detect.

“The upcoming period will be the most stressful, high-risk and grim period for epidemic prevention and control in our city,” a Shenzhen official told the news conference.

“Markets could once again be hit in the next couple of weeks, likely triggering another round of cuts by economists on the street,” Japanese finance company Nomura warned in a note on Tuesday, adding that the situation might be worsening, as omicron has spread to large cities.

Nearly a quarter of European companies in China are considering shifting their investments out of the country thanks in large part to the nation’s strict covid policies, results from a survey released in June by the EU Chamber of Commerce in China said. Similar sentiment was echoed in other reports from American and British chambers of commerce.

Despite Beijing taking some heed of the negative sentiment from foreign conglomerates, resulting in some easing of the rules earlier this summer, there are still plenty of signs of big brands looking for alternative manufacturing sites outside of China, an issue that will be under the spotlight in tomorrow’s issue of Splash Extra.

Sam Chambers August 30, 2022