November 25, 2022 Container News

Martina Li, Asia Correspondent

Further slides in the Shanghai Containerized Freight Index (SCFI) are continuing, and it is expected that in December, freight levels will be at pre-pandemic levels.

On 18 November, SCFI stood at 1,307 points, plunging 74% from an all-time high of 5,110 points on 7 January, and bringing the index near the 1,000 points seen in January 2020, just before the Covid-19 crisis erupted.

Shanghai-North Europe freight rates, having peaked at US$15,600/TEU on 14 January, dived to US$2,350/TEU on 18 November. On the same date, Shanghai-US West Coast rates fell to U$1,550/FEU, from a high of US$8,100/FEU in February. Shanghai-US East Coast routes lost 67%, from a high of US$11,800/FEU in January to US$3,900/FEU on 18 November.

Declines were also registered for shipments from Shanghai to the Persian Gulf, South America and Australia.

The all-time high rates are not reflective of what shippers actually paid, as tight container availability compelled them to pay premiums to be assured of slots.

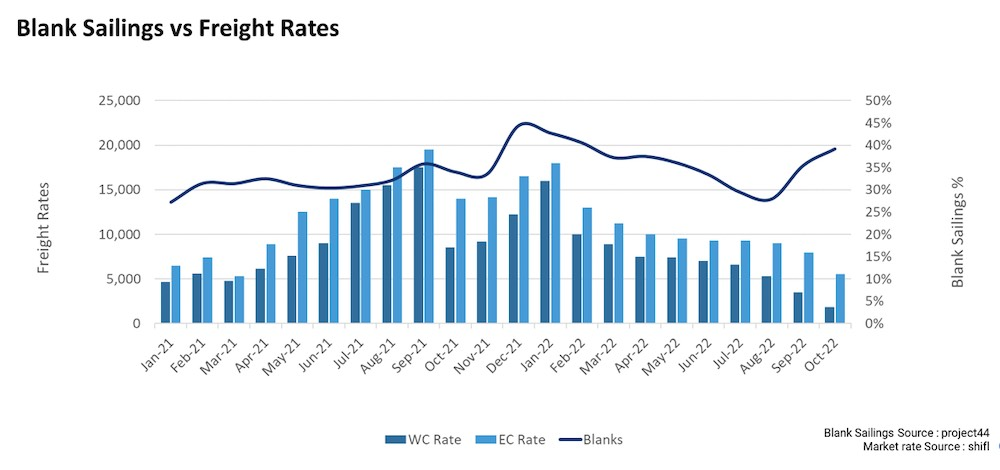

The chief cause of the weakening rates is a drastic fall in headhaul cargo demand, a trend going back to August.

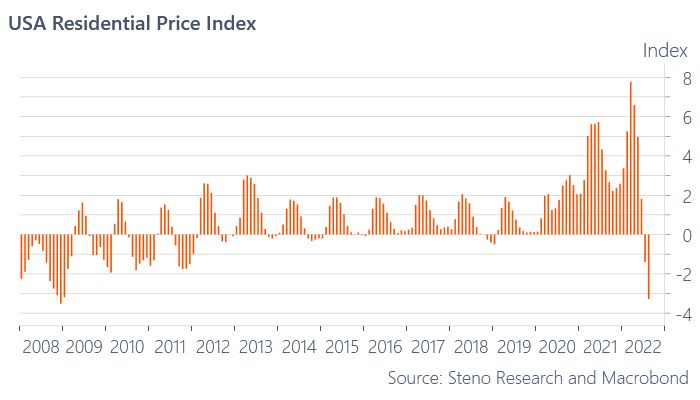

Global inflation, spawned by rising energy prices following Russia’s invasion of Ukraine in February, has discouraged consumer spending. In turn, retail sales have been sluggish, resulting in warehouses in Europe and the United States becoming full.

Container Trades Statistics show a massive drop in the Far East – North America volumes of 25% in September. Volumes shipped from Asia to Europe are also estimated to have plunged 20% in the same month. The usual Q3 peak effect of extra shipments at the end of September before the Golden Week holidays in China in the first week of October did not materialise this year.