Spectre of boxship lay-ups returns

With multiple capacity levers deemed insufficient to halt the severe decline in container freight rates, the spectre of ship lay-ups has been raised.

Rates remain elevated in historical terms, but the plunges recorded over the past few months have spooked some in the industry with many smaller operators taking the decision to exit the main east-west trades.

Contract rates remain resilient for the time being. The latest data from the Xeneta Shipping Index reveals global contracted rates fell by only 0.6% this month, following on from September’s 1.1% decline. This disparity in pricing between spot and contract is seeing many shippers play the markets.

“What we may well see is shippers looking to transfer volumes to the spot market, spooking carriers desperate to tie-in business. The result? Carriers could be forced to lower those coveted contracted rates,” said Xeneta CEO Patrik Berglund today.

According to Sea-Intelligence, spot rates on the transpacific to the west coast of the US are still up 54% compared to the same period of time in pre-pandemic 2019, while prices from Asia to North Europe are up by 146% compared to the same period three years ago.

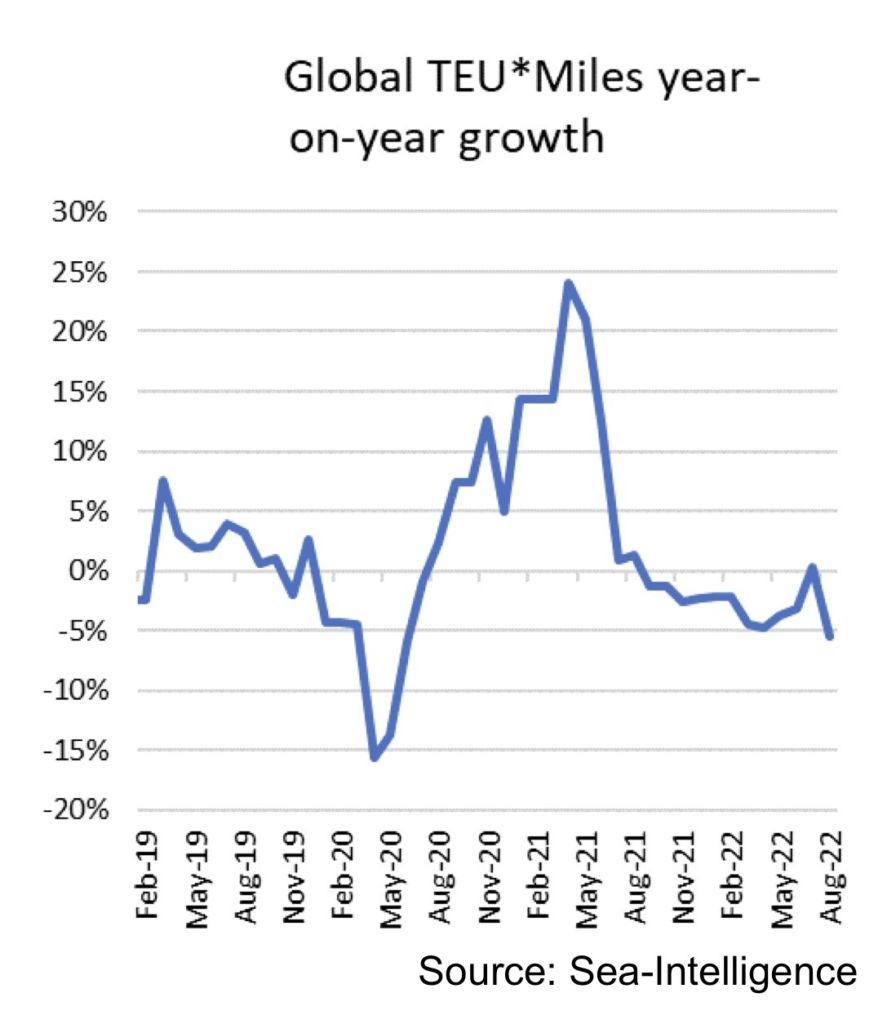

Nevertheless, Sea-Intelligence, along with many other liner experts, is forecasting a hard landing for container shipping with rates continuing to slide in the coming weeks, potentially going below 2019 levels, before a rebound kicks in.

“If the market continues to deteriorate rapidly in the coming week – and especially if this is driven by a sharp global recession – then the raft of blank sailings we should expect in the coming weeks and months, could in 2023-Q1 turn into carriers not only idling vessels, but temporarily placing them in lay-up, as we also saw in 2009,” Sea-Intelligence suggested in its latest weekly report, published yesterday.

Other analysts have been highlighting how blanked sailings and service suspensions have not been enough to halt freight rate declines, while scrapping, another traditional lever in the liner defensive armoury, may not help out as much as some liner executives are hoping.

HSBC urged carriers last week to blank and suspend more services to stabilise spot freight rates ahead of the upcoming contract negotiations for the Asia-Europe route.

“The blanked sailings have been ineffective in preventing freight rates from sliding on all main trades, with the Middle East the only notable exception,” noted researchers at Linerlytica in their latest weekly reporter.

On the demolition side, Alphaliner data shows there is a total of 655,149 teu of scrappable tonnage of 25 years of age and older, but a much bigger overall 2.5m teu of potential recycling candidates totalling 1,102 vessels which are 20 years of age and older.

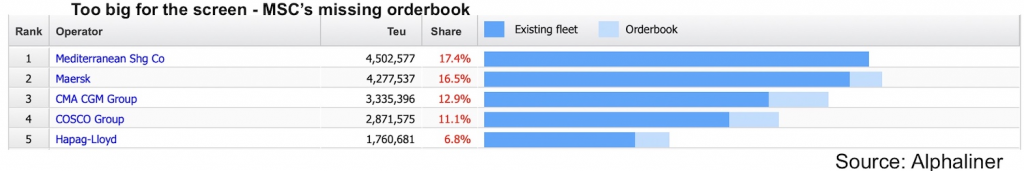

“Although the removal of 2.5m teu of capacity aged 20 years and over would be instrumental in helping mitigate the impact of the 5.1m teu newbuild capacity to be delivered within the next two years, this is just not going to happen overnight,” Alphaliner warned in its latest weekly report, highlighting the record orderbook due to deliver soon.

In the event that carriers do decide to lay up ships, Sea-Intelligence has warned shippers to watch out for a rates surge once the markets rebound as carriers would be unable to reactivivate vessels fast enough. The subsequent lag time would cause capacity shortages and a rate surge, similar to 2010, in the rebound after the financial crisis.

“Shippers should therefore pay heed to the carriers’ actions in the coming months. If we begin to see carriers placing vessels in lay-up, then the scene is already set for a rate surge on the backside of the recession,” Sea-Intelligence advised.