Mediterranean Shipping Co’s lead over 2M partner Maersk at the top of the liner rankings has stretched beyond the 100,000 teu mark, a gap that is set to widen considerably further in the months ahead.

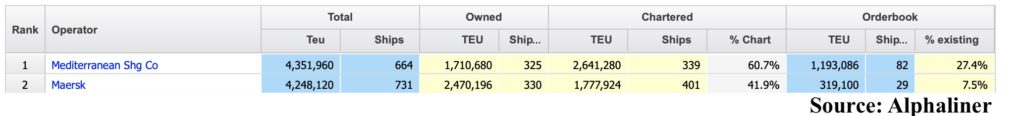

Latest data from Alphaliner shows the Aponte family-controlled MSC has 4,351,960 slots in its fleet compared to Maersk’s 4,248,120. Alphaliner reported MSC surpassing Maersk in fleet size on January 6, the first time in a quarter of a century that Maersk has not been at the top of containerline rankings. Moreover, MSC’s orderbook, the largest in the industry by some distance, will ensure the gap widens beyond 500,000 teu in the coming months.

Starting out in 1970 with a German-built secondhand vessel of just 2,900 dwt, acquired from Hapag-Lloyd and renamed Patricia, MSC, now headed by former Maersk COO, now operates 664 ships of which 186 have been bought on the secondhand market since August 2020, the greatest fleet buildup in the 66 years of containerisation.

In recent years Maersk has repeatedly stated its intention be a logistics integrator with a fleet no larger than 4m to 4.4m teu.

“If MSC ends up having more capacity than we do, that’s not the end of the world,” Maersk CEO Søren Skou said during Maersk’s capital markets day last May. “That’s not how we think about being number one. Our focus is on having a much higher turnover per container that we ship.”

In similar comments, MSC’s Toft said in the wake of surpassing his old employers three months ago: “Size isn’t an objective for us. At MSC, we never set a specific target to be the biggest. Growth, profitability and supporting customers are what have driven us, and what will continue to drive us forward.”

Sam Chambers.